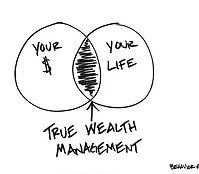

There is no such thing as an independent financial decision.

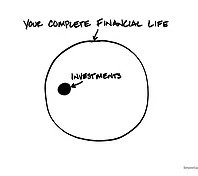

Every financial decision we make impacts various components of our financial picture and in many cases, those we love most. We understand that a decision to start a new business or to send a child to private school must be made in correlation with other goals and dreams. This is why we focus on much more than choosing and managing the right investments.

Our financial planning process is intentional, comprehensive and ongoing.

We spend time getting to know you and craft specific recommendations based on your unique situation and walk with you step-by-step as we implement your plan. From tax, estate, and education planning to insurance analysis, investment management, and charitable gifting strategies, you can be confident that our team of professionals has thoughtfully considered all aspects of your financial life. And when life changes, as it inevitably seems to do, we will be here to monitor and adjust your plan accordingly so that you don’t have to worry.